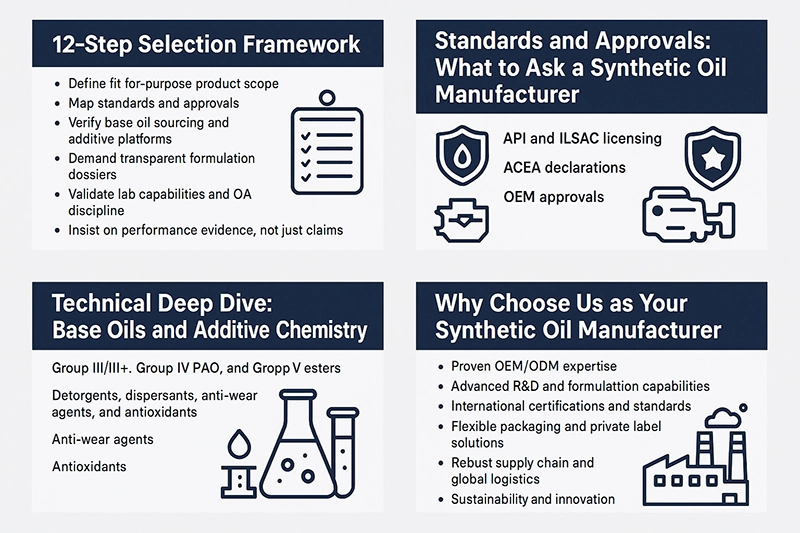

Choosing a synthetic oil manufacturer for OEM/ODM programs requires a disciplined method that validates standards, approvals, formulation quality, capacity, and lifecycle support. The framework below turns that choice into a repeatable 12-step process—practical for procurement teams, distributors, and private-label programs scaling from pilot runs to global distribution.

A credible partner safeguards engine durability, emissions systems, and warranty compliance while protecting margins. The right synthetic oil manufacturer delivers: consistent base-oil sourcing, proven additive chemistry, validated approvals (API/ILSAC/ACEA and OEM certifications), robust QA labs, and dependable logistics across drums, IBCs, and retail packs. External standards such as API SP, ILSAC GF-6, ACEA 2023 sequences, and viscosity grades per SAE J300 provide objective benchmarks for comparison.

Passenger car vs. heavy-duty diesel vs. industrial use.

Viscosity grades: 0W-16 to 5W-40 for modern gasoline engines; 5W-30/5W-40 for diesel; niche grades for fleets.

Compatibility with aftertreatment devices such as DPFs and GPFs, and fuels including E10–E85, CNG/LPG, and biodiesel blends.

API gasoline categories (SP) and ILSAC GF-6 for modern passenger cars.

ACEA 2023 sequences for light-duty engines, including low-SAPs categories.

SAE J300 viscosity grades for winter and operating-temperature limits.

Request OEM approvals (e.g., VAG 504/507, MB 229.x, BMW LL) where relevant.

Identify base-oil groups (III/III+, IV PAO, V esters) used by SKU and any multi-source contingencies.

Confirm additive supplier families and change-control procedures when components vary.

Review data for volatility (NOACK), oxidation stability, LSPI mitigation, and deposit control.

Technical Data Sheets with kinematic viscosity at 40/100 °C, VI, HTHS (where applicable), pour point, CCS/MRV, NOACK, and SAPs.

Safety Data Sheets aligned with GHS and region-specific chemical registers.

In-house or accredited partner labs for routine tests (e.g., viscosity, TBN, foam, ICP metals).

ISO 9001/14001/45001 certifications with valid dates on file.

Engine tests where category-required (e.g., Sequence IIIH for oxidation, IVB for valvetrain wear, LSPI tests).

Bench and field trials with clear protocols and target metrics.

Small packs (1–5 L), 20 L pails, 200 L drums, and 1000 L IBCs.

Private-label artwork workflows and tamper-evident closures.

Serial coding and traceability by batch across regions.

Stock policies for base oils, additives, and packaging; approved alternates with equivalency data.

Lead-time SLAs for forecasted and spot orders; surge capacity for promotions and seasonal peaks.

Waste management, VOC and emissions reporting, and responsible sourcing declarations.

Energy use optimization and recycled plastics in packaging; regular ESG reporting.

Account for freight, duties, hazmat fees, customs brokerage, warehousing, and stock-out risk.

Run sensitivity scenarios on exchange rates and raw-material indices.

Define MOQs, volume-tier pricing, payment terms, penalties or bonuses, and rework or replacement SLAs.

Change-notification windows for formula, label, or spec updates; side-by-side testing before cutover.

Pilot with 1–2 SKUs, verify batch-to-batch COAs, run customer trials, then scale breadth and geography.

Quarterly reviews watching returns, complaint codes, on-time delivery, and spec compliance.

Modern full-synthetic formulations often blend Group III/III+ with Group IV (PAO) and small percentages of Group V esters for seal compatibility and cleanliness. Detergent systems manage deposits and neutralize acids; dispersants keep soot and oxidation byproducts suspended; anti-wear agents with controlled phosphorus levels, friction modifiers, antioxidants, and viscosity modifiers round out the package. The objective is to meet API/ILSAC/ACEA targets while delivering stability under high shear and temperature, especially for turbocharged GDI engines susceptible to low-speed pre-ignition.

SAE J300 defines viscosity grades such as 0W-20, 5W-30, and 5W-40 with winter ratings and operating-temperature limits. Winter ratings indicate cold-cranking and pumping performance, while kinematic viscosity windows at 100 °C and HTHS thresholds confirm stability under load. Always reconcile formulation data with OEM recommendations and climate conditions in the target market.

API and ILSAC licensing: provide active EOLCS license numbers and category declarations (e.g., API SP, ILSAC GF-6A/B).

ACEA declarations: self-certification to current sequences (e.g., C2/C3/C5/C6) with test summaries and quality management participation.

OEM approvals: official listings or letters (e.g., VAG 504 00 / 507 00) on file; reconcile viscosity grade and SAPs with OEM specs.

Batch-level certificates of analysis with viscosity, VI, HTHS (if applicable), TBN/TAN, pour point, flash point, and metals.

Retained samples policy and complaint-investigation reports with root-cause analysis and corrective actions.

Annual method correlation (round robins) and equipment calibration logs.

Artwork workflows with regulatory text, hazard icons, barcodes or QR, and bilingual labeling where required.

Security inks, holograms, or serialized seals; distributor education for field authentication.

Private Label: maximum brand control; ensure contractual rights to formula continuity and packaging molds.

Co-Brand: leverage the manufacturer’s approvals and recognition for faster market entry on complex specs.

Vague additive descriptions, missing API or ACEA identifiers, or expired certificates.

Inconsistent COA values relative to TDS; unexplained batch-to-batch drift.

No written change-control procedure; sudden viscosity-index shifts or base-oil substitutions.

Corporate overview, plant locations, capacity, and downtime plans.

TDS/SDS, example COA, approvals list, API/ILSAC/ACEA declarations, and QMS certificates.

Packaging proofs, artwork timelines, pallet specs, and logistics options.

MOQ, lead times, standard pricing, volume tiers, and FX adjustment policy.

Compliance and Approvals – 25%

Quality Systems and Lab Capability – 20%

Supply Chain and Capacity – 15%

Cost and Commercial Flexibility – 15%

Technical Support and Claims Transparency – 10%

Packaging and Brand Support – 10%

Sustainability and Compliance Posture – 5%

Subject: RFQ – Full Synthetic PCMO (API SP/GF-6), 0W-20 and 5W-30

Scope: Private-label 0W-20 and 5W-30 for gasoline GDI/TGDI engines, low-SAPs compatibility with aftertreatment.

Volumes: Initial two 20 ft containers (mixed), forecast for 18 months attached.

Standards: API SP/GF-6 and ACEA C5/C3 as applicable; include any OEM approvals.

Deliverables: TDS/SDS, COA templates, example labels, and safety documentation.

Selecting the right partner is not just about meeting technical specifications; it is about building a long-term collaboration that aligns with your strategic growth. At fahr-engineoil.com, we provide comprehensive solutions that go far beyond supplying oil. Procurement teams, OEM clients, and international distributors consistently choose us as their trusted synthetic oil manufacturer for the advantages outlined below.

Dedicated OEM and ODM programs tailored to regional regulations and market needs.

Flexible project control from pilot runs to high-volume production with transparent milestones.

Consistent quality and documentation for brand launches and private-label expansions.

Formulations leveraging Group III+, Group IV PAO, and selected esters for stability and cleanliness.

Targeted performance on oxidation resistance, wear protection, and fuel efficiency.

Bench and engine testing aligned with current API, ACEA, and OEM requirements.

Alignment with API SP, ILSAC GF-6, ACEA 2023 sequences, and multiple OEM approvals.

Quality, environment, and safety certifications including ISO 9001, ISO 14001, and ISO 45001.

Compliance documentation and approval evidence maintained for audits and tenders.

Packing options from bulk IBCs to small retail packs for multi-channel distribution.

Artwork support, tamper-evident features, and multilingual labels for rapid market entry.

Batch traceability and serial coding to strengthen brand integrity and recalls management.

Strategic sourcing and buffer stocks to mitigate raw-material volatility.

Multiple logistics partners for reliable lead times and seasonal surge capacity.

Forecast collaboration to optimize inventory and reduce total landed cost.

Reduced VOC emissions, energy-efficient operations, and responsible materials selection.

Recycled packaging initiatives and continuous process improvements.

ESG reporting cadence to support partners’ sustainability objectives.

Guidance on standards compliance, oil selection, and market positioning.

Training, product data packs, and launch support for distributors and OEMs.

Field performance monitoring and responsive issue-resolution workflows.

When you partner with Fahr Engine Oil, you gain more than a supplier—you gain a strategic ally committed to your growth. Whether your goal is to launch a private-label program, secure OEM approvals, or expand into new markets, we deliver the expertise, certifications, and service you need. Learn more at fahr-engineoil.com and discover how our synthetic oil solutions can support your OEM/ODM growth today.

You can try searching

Hot Recommendations

Hot Products

DE-Rust Lubricating Spray | Bulk Orders and Custom Solutions for OEM ODM

Carburetor Cleaner | Professional Engine Carburetor Cleaner for OEM ODM Supply

Fahr Multifunction Foam Cleaner | Professional Automotive Cleaning Spray for OEM ODM Supply

Fahr Aerosol Spray Paint | OEM ODM Automotive Coatings for Bulk Orders and Custom